Your credit history isn't just numbers—it's the story of your financial habits. Every payment, loan, and credit card application contributes to a narrative that lenders read to determine your trustworthiness and shape your financial opportunities.

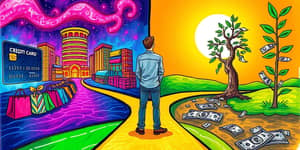

Understanding how to craft and control this narrative can open doors to favorable loan terms, lower interest rates, and greater purchasing power. By treating your credit as a story you write and refine, you gain empowerment to steer your financial future toward success.

The Foundation of Your Credit Story

At its core, your credit narrative is built on two key elements: your credit report and your credit score. Think of your credit report as a detailed diary and your credit score as its headline.

A detailed multi-page record of your borrowing history captures every account you hold, payment date, outstanding balances, and credit inquiries. In contrast, your three-digit score summarizes this data into a single gauge of your creditworthiness. Together, they form the bedrock of your financial reputation.

Understanding Your Financial Story

Your credit score is influenced by five major factors that together weave the tapestry of your financial behavior:

Recognizing the Pitfalls: Negative Narratives

Several missteps can cast your credit story in a negative light, reducing your access to credit and increasing costs:

- Late or missed payments creating delinquencies and collections.

- Carrying a balance can have a stronger effect than you might expect.

- Multiple hard inquiries signaling financial distress.

- Closing unused cards and shrinking your total credit availability.

Building a Positive Narrative

Shifting from a negative credit story to a positive one involves consistent habits and strategic choices:

- Make all payments on time, every time, to build an unblemished record.

- Maintain credit utilization below 30% of each limit.

- Keep older accounts open to extend your credit history.

- Mix different types of credit responsibly to enhance your profile.

The Lender’s Perspective

Lenders read your credit narrative to gauge risk and decide on loan terms. A strong history indicates lower risk, making you eligible for lower interest rates and favorable loan terms. They also use this story to set credit limits, insurance premiums, and rental deposits.

By providing a clear narrative that highlights your responsible behavior and financial discipline, you can negotiate better terms and influence decisions in your favor.

Taking Control of Your Narrative

Every great story needs an editor. Take charge of your credit narrative with these actionable steps:

- Checking your credit report for errors at least once a year and disputing inaccuracies promptly.

- Setting up automatic payments or reminders to avoid missed due dates.

- Paying down existing balances and avoiding new debt when possible.

- Strategically applying for new credit to diversify your mix without excessive inquiries.

- Monitoring your score and report to track progress and adjust your strategy.

By viewing your credit as a narrative you author, you gain the insight and motivation to shape it proactively. Whether you’re aiming to buy a home, lease a car, or secure a small business loan, a strong credit story paves the way toward your financial goals.

Start today by reviewing your report, understanding the chapters to revise, and implementing these strategies. With diligence and informed choices, you can craft a credit narrative that not only reflects who you are but also unlocks the opportunities you deserve.

References

- https://www.scorekyahua.bank.in/blogs/the-full-story-vs-the-headline-credit-score-vs-credit-report/

- https://www.sccu.com/articles/personal-finance/how-credit-score-can-impact-purchasing-power

- https://starfieldsmith.com/2019/10/best-practices-the-importance-of-providing-a-detailed-narrative-in-the-credit-memo-when-documenting-credit-elsewhere/

- https://drbank.com/whats-new/your-credit-score-and-its-impact-on-your-personal-financial-goals/

- https://www.citadelbanking.com/citadel-financial-wellness/learn-and-plan/surprising-financial-decisions-that-can-affect-your-credit

- https://mycreditunion.gov/brochure-publications/brochure/money-basics-guide-building-and-maintaining-credit

- https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-affects-your-credit-scores/

- https://www.cerebrocapital.com/blog/framing-your-narrative/

- https://nul.org/blog/your-credit-why-credit-reports-and-scores-matter-your-financial-health

- https://www.clearviewfcu.org/Resources/Learn/Blog/Understanding-your-Credit-Profile

- https://financialaid.berkeley.edu/center-for-financial-wellness/financial-literacy-hub/understanding-credit/

- https://www.datarails.com/finance-glossary/financial-narrative-processing/

- https://www.equifax.com/personal/education/credit/score/articles/-/learn/5-things-that-may-hurt-your-credit-scores/

- https://www.chase.com/personal/credit-cards/education/build-credit/financial-decisions-that-lead-to-poor-credit