Credit card interest can feel mysterious until you see the numbers in action. When you carry a balance, every dollar borrowed has a daily cost, and over time those dollars can add up—sometimes more than you expect. This guide unpacks how interest accrues, the fine print of APRs, and practical strategies to keep more money in your pocket.

Understanding the Basics of Credit Card Interest

At its core, credit card interest is the price you pay for borrowing money. Expressed as the Annual Percentage Rate (APR), it represents both the nominal rate and any fees wrapped into your borrowing cost. If you don’t pay your full balance by the due date, issuers calculate interest every day on what you owe, turning your convenience into a cost.

Types of Credit Card APRs

Not all APRs are created equal. Your statement may list several rates depending on the type of transaction, each with its own rules and triggers.

- Purchase APR: The rate applied to everyday buys when you carry a balance past the grace period.

- Balance Transfer APR: Often promotional, this may be 0% for a set time before jumping to a standard rate.

- Cash Advance APR: Begins accruing immediately, typically at a higher percentage with no grace period.

- Penalty APR: A steep rate triggered by late or returned payments, usually after a 45-day notice.

- Variable vs. Fixed APRs: Variable rates fluctuate with the prime rate; fixed rates remain steady unless your issuer changes terms.

How Interest Charges Are Calculated

Understanding the math helps you see why balances grow. Issuers convert your APR into a daily periodic rate calculation by dividing by 365 (or 360). They multiply this rate by your average daily balance method and then by the number of days in your billing cycle.

For example, a 19% APR yields a 0.052% daily rate. If you maintain a $1,000 average balance over 31 days, you’ll incur about $16.12 in interest (0.00052 × $1,000 × 31).

Maximizing the Grace Period

Most cards offer a window between your statement closing date and payment due date where purchases carry no interest. Paying the full statement balance by that due date means you avoid interest on new purchases entirely. However, any cash advances or balances carried from a prior cycle lose this benefit instantly.

Compounding and the Real Cost

Unlike simple interest, credit card interest compounds—usually daily or monthly. That means each day’s unpaid interest adds to your principal, and future interest calculations include that added amount. Over a year, a 20% APR on a constant $1,000 balance results in about $220 in charges instead of $200 under simple interest.

Factors That Influence Your APR

Several elements determine the rate you receive when you apply for or hold a credit card:

- Credit Score: Higher scores typically unlock lower APR offers.

- Payment History: On-time payments signal reliability; missed payments can trigger penalty rates.

- Card Type: Rewards and premium cards often carry higher APRs to offset benefits.

- Market Rates: Variable APRs track an index, like the prime rate, causing fluctuations.

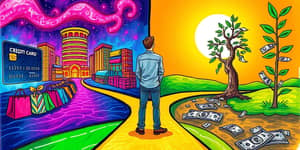

Strategies for Paying Less Interest

Even if you carry a balance occasionally, these tactics can trim what you owe:

- Pay more than the minimum each month to reduce principal quickly.

- Apply extra payments to the balance with the highest APR first.

- Make payments multiple times during the cycle to lower your average daily balance.

- Consider a 0% intro balance transfer, but watch for fees that offset savings.

Promotional and Penalty APRs

Many cards lure you with 0% introductory APR periods lasting 12–21 months on purchases or transfers. While appealing, watch out for balance transfer fees—often 3%–5% of the amount moved. Conversely, a late payment can trigger a penalty APR after missed payments, sometimes above 25%, so set reminders to avoid hefty spikes.

Debunking Common Myths

Myth: Interest only accrues once a year. Reality: It compounds daily, making small balances grow faster than you expect. Myth: Paying the minimum prevents debt growth. In truth, minimum payments primarily cover interest and fees, barely touching principal—and can keep you in debt for years.

Putting It All Into Practice

Armed with knowledge of how interest works, you can take control of your finances. Review your monthly statement for APR details and cycle dates. Use online calculators or even a simple spreadsheet to project interest charges under different payment scenarios. Then, commit to strategies that align with your budget and goals.

By focusing on timely payments, smart balance transfers, and consistent extra contributions, you’ll watch your balances shrink and your savings grow. In the world of credit cards, knowledge isn’t just power—it’s profit.

References

- https://www.bankrate.com/credit-cards/advice/how-credit-card-interest-is-calculated/

- https://www.nerdwallet.com/credit-cards/learn/how-is-credit-card-interest-calculated

- https://www.consumerfinance.gov/ask-cfpb/how-does-my-credit-card-company-calculate-the-amount-of-interest-i-owe-en-51/

- https://www.capitalone.com/learn-grow/money-management/calculate-credit-card-interest/

- https://www.usbank.com/credit-cards/credit-card-insider/credit-card-basics/how-does-credit-card-interest-work.html

- https://www.chase.com/personal/credit-cards/education/interest-apr/how-to-calculate-credit-card-apr-charges