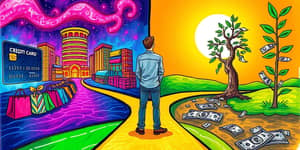

The aspiration for financial liberty is universal. Yet few recognize that credit scores often serve as a key that unlocks financial freedom. From securing low-interest mortgages to starting a business, scores dictate opportunities and influence life’s most significant purchases. Embracing a credit-conscious mindset transforms this numeric metric into a powerful ally. By understanding how each decision impacts credit, you gain leverage to steer toward independence rather than stumbling on hidden pitfalls.

In the modern economy, credit behaves like a double-edged sword. Responsible consumers may underutilize credit, while others spiral into debt with soaring interest. Addressing these contradictions demands both insight and action. Learning the mechanics of credit scoring and debt management lays the groundwork for sustainable wealth. As you navigate this path, remember that strategic planning and disciplined execution form the cornerstone of lasting success.

The Credit Score Paradox

The credit system presents a fundamental contradiction. To build credit, you must borrow, yet borrowing with poor credit often incurs prioritize high-interest debts first excessive fees and high rates. Lenders rely on algorithms that capture only snapshots of your financial behavior, sometimes overlooking steady bill payments and smart budgeting. This paradox traps well-meaning borrowers, making it harder to break free without targeted strategies and professional guidance.

Awareness of this paradox compels us to redefine credit’s role: not as a burden, but as a tool. By deliberately using credit and monitoring its impact, you transform liabilities into stepping stones. Cultivating this perspective unlocks new doors, turning credit scores into dynamic gauges of your progress, rather than static judgments of past mistakes.

Mastering Debt: Five Proven Strategies

Debt repayment remains the linchpin of credit improvement. Embracing structured approaches injects clarity and confidence into what can feel overwhelming. These methods blend mathematical efficiency with psychological reinforcement, ensuring both momentum and savings over time. By selecting the right strategy, you accelerate payoff and maintain motivation for the long haul.

- Snowball Method – Tackle the smallest balance first while paying minimums on others, then redirect former payments to the next debt, fostering building momentum through small victories.

- Avalanche Method – Focus on the highest interest rate debts initially to minimize total interest paid, saving money over the life of your loans.

- Power Payment Method – After eliminating one obligation, roll its payment into another balance. Each success compounds, reducing timelines exponentially.

- Debt Consolidation Loan – Combine multiple debts under one lower-interest loan. Consolidation simplifies payments and offers predictable terms for easier management.

- Balance Transfer Cards – Move high-rate credit card balances to a 0% introductory card. Use the interest-free period strategically, staying vigilant about transfer fees and deadlines.

Building and Maintaining a Stellar Credit Score

Credit scores reflect complex algorithms evaluating history, utilization, and diversity. Working toward exemplary marks means addressing each factor deliberately. Consistent on-time payments and low balances signal reliability, while a mix of account types showcases experience and versatility. These elements converge to shape your profile in lenders’ eyes, empowering you to negotiate improved terms.

The Role of Budgeting and Emergency Funds

Effective budgeting forms the blueprint of debt management. Adopting frameworks like the 50/30/20 rule grounds spending decisions in concrete limits—allocating half of your income to essentials, thirty percent to lifestyle, and twenty percent to debt or savings. This approach sharpens awareness of financial habits, guiding you to adjust expenditures and free up cash for obligations.

Alongside disciplined budgets, cultivating an emergency fund offers a buffer against unexpected shocks. By setting aside three to six months of living expenses, individuals shield themselves from costly borrowing during crises. This principle—that emergency funds build long-term stability—underscores how liquidity safeguards credit profiles and nurtures confidence for future ventures.

Psychological Momentum and Long-Term Success

Financial transformations hinge on mindset as much as tactics. Witnessing debts vanish through the Snowball Method reinforces resolve, reminding you that incremental progress compounds into profound change. Establishing rituals—regularly reviewing goals, celebrating milestones, and visualizing successes—fuels sustained motivation and wards off setbacks.

Professional support, in the form of credit counseling or certified planners, offers tailored strategies and accountability. These experts decode complex reports and negotiate with creditors, smoothing your path forward. Their insights demystify jargon, turning daunting balances into manageable targets and illuminating the broader horizon of wealth building.

Implementing Your Path to Freedom

Moving from theory to action demands a clear, step-by-step framework. Prioritizing tasks and tracking outcomes ensures each decision aligns with your overarching vision. Remember that effective debt management improves credit scores gradually but significantly—every payment inches you closer to opportunity.

- Assess all outstanding balances and interest rates.

- Create a realistic monthly budget reflecting priorities.

- Select and commit to a repayment strategy.

- Pay above minimums when possible to reduce principal.

- Avoid accumulating new debt during payoff periods.

- Monitor credit utilization and payment history diligently.

- Consider professional guidance from credit counselors.

- Negotiate with creditors for reduced rates or modified terms.

Your journey culminates in enhanced purchasing power and genuine choice. With improved scores, you access lower interest rates, higher loan amounts, and more favorable insurance premiums. As you near your objectives, remember to diversify credit mix over time, reinforcing stability and opening new vistas, whether that’s a dream home, a vehicle, or a business startup.

References

- https://www.farther.com/resources/foundations/debt-management-strategies-for-financial-freedom

- https://www.sccu.com/articles/personal-finance/how-credit-score-can-impact-purchasing-power

- https://www.glcu.org/resource-center/blog/mastering-debt-management-a-blueprint-to-financial-freedom/

- https://standtogether.org/stories/the-economy/why-does-credit-score-matter-and-why-it-shouldnt-define-us

- https://moneytreewm.co.uk/financial-advice/top-5-debt-management-strategies-for-financial-freedom/

- https://www.chevronfcu.org/articles/post/chevron-blog-posts/2024/03/01/beyond-numbers-the-impact-of-your-credit-score-on-everyday-life

- https://www.mutualofomaha.com/advice/financial-planning/managing-debt/how-to-get-out-of-debt-and-regain-your-financial-freedom

- https://www.securitybankusa.bank/blog/post/unlocking-financial-freedom-improving-your-credit-score

- https://www.associatedbank.com/education/articles/personal-finance/loans-and-debt/how-to-get-out-of-debt-strategies

- https://www.experian.com/blogs/ask-experian/credit-education/life-events/

- https://www.guidestone.org/Resources/Education/Articles/Investments/Three-Strategies-to-Help-You-Get-Out-of-Debt

- https://nul.org/blog/your-credit-why-credit-reports-and-scores-matter-your-financial-health

- https://nylag.org/unlocking-financial-freedom-overcome-debt-with-savings-strategies-that-work-for-you/

- https://operationhope.org/data-impact/financial-wellness-index/

- https://www.investcarlisle.com/blog/mastering-debt-management-a-guide-to-financial-freedom