In an era defined by AI breakthroughs, shifting policies, and heightened economic volatility, constructing a portfolio that endures uncertainty is essential. This guide offers a compelling narrative and practical tactics to help you build resilience, balance opportunity, and protect capital through 2026 and beyond.

The Importance of Structure Over Speculation

Defensive investing demands structure over speculation in every decision. A well-designed framework prevents emotional trading and ensures you have clear processes for adding, trimming, or exiting positions.

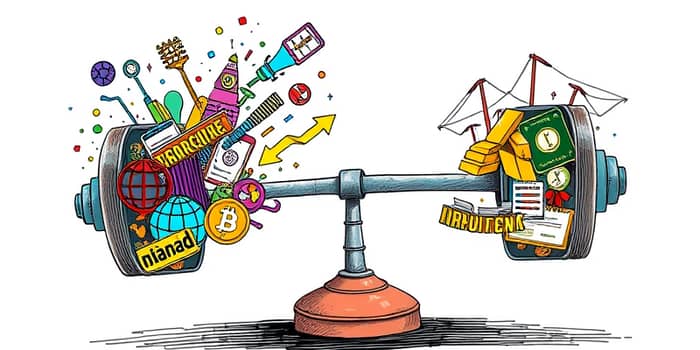

By prioritizing diversification, liquidity, and realistic expectations, you can avoid the pitfalls of chasing outsized returns. A measured approach accommodates both growth outlooks—such as AI and technology—and protective elements like bonds, real assets, and dividend-paying shares.

Avoiding Common Defensive Pitfalls

Seven frequent mistakes can derail even the most carefully planned portfolios. Recognizing and counteracting these errors forms the foundation of any defensive playbook:

- Lack of diversification: Avoid regional, sector, or single-factor concentration by blending global stocks, fixed income, real assets, and non-market strategies.

- Illiquidity: Maintain a deliberate cash buffer to prevent forced sales during downturns.

- Unrealistic returns: Use return ranges rather than fixed targets; favor quality through strong cash flows and reasonable valuations.

- No selling rules: Establish clear exit criteria and rebalance periodically to lock in gains or cut losers.

- Over-reliance on single factors: Treat gold, commodities, or one strategy as insurance, not your primary return driver.

- Ignoring non-market returns: Supplement equities and bonds with event-driven, litigation finance, or contractual yield sources to lower correlation.

- No risk budget: Define your volatility tolerance and align position sizes to stay within your risk comfort zone.

Building Blocks of a 2026 Defensive Strategy

Successful defensive portfolios rest on four pillars: liquidity, controlled growth, real assets, and market-external income. Integrating these components offers the agility to capture upside while guarding against downturns.

First, liquidity as a deliberate protective buffer is non-negotiable. Holding cash or cash equivalents allows you to rebalance into opportunities when asset prices sell off, rather than scrambling for capital in a pinch.

Second, global diversification and controlled growth exposure keeps you connected to secular themes—AI, technology, productivity gains—while limiting overconcentration in U.S. large-cap and megacap tech names. Use broad ETFs or selective active strategies to manage regional and style biases.

Third, real assets like gold and commodities serve as crisis stabilizers. Treat these allocations as insurance: keep them modest, recognizing they buffer extreme scenarios rather than drive performance in normal markets.

Fourth, market-external returns to reduce correlations introduces strategies like event-driven credit, litigation financing, and contractual yields. These sources often move independently of stocks and bonds, smoothing portfolio returns.

Specific Defensive Investment Plays

Equity Strategies: Balance Growth and Protection

The core of growth lies in selective exposure to AI and technology, balanced by defensive equities. A barbell approach pairs high-potential names with sectors known for stability.

- Growth side: Leading AI and technology innovators with strong competitive moats.

- Defense side: Dividend growers, listed infrastructure, and utilities offering predictable earnings and conservative balance sheets.

To offset U.S. large-cap concentration—where over a third of the S&P 500 sits in tech—consider small-cap value or international stocks. European banks, Japanese exporters, and emerging-market debt funds diversify exposures and may benefit from a weaker U.S. dollar.

Fixed Income and Bonds

With yields elevated, high-quality fixed income regains its defensive shine. Young investors might start with 5% bond allocations 35–40 years from retirement, ramping up to 20% when two decades away. After age 50, a higher weighting in short-to-intermediate maturities can help preserve capital.

Active management shines amid policy uncertainty and heavy debt issuance from AI capex. Select strategies that emphasize credit quality and flexible duration to navigate rate volatility.

Alternative Assets and Non-Market Income

Integrating low-correlation sources like litigation financing, event-driven credit, and securitized assets can enhance returns while tempering overall volatility. These strategies often operate on contractual yields or unique risk premia, making them effective diversifiers.

Maintain a modest gold position as insurance against extreme market stress, and ensure any commodities exposure aligns with your overall risk budget rather than serving as a primary growth engine.

Conclusion: Owning Risk Deliberately

Defensive investing in 2026 is not about hiding from opportunity; it’s about choosing risks intentionally and structuring your portfolio for the long haul. By embracing risk-defined roles for each asset, maintaining liquidity as a buffer, and diversifying across both market and non-market sources, you can position yourself for resilient growth.

Remember the adage: “Hope belongs in church, not your portfolio.” With thoughtful planning, disciplined execution, and ongoing review, you’ll transform uncertainty into opportunity and safeguard your financial future.

References

- https://www.aequifin.com/en/blog/secure-investing-in-2026-which-seven-mistakes-cost-investors-their-wealth/

- https://www.nuveen.com/en-us/insights/investment-outlook/annual-2026-outlook-best-investment-ideas

- https://www.morningstar.com/portfolios/5-smart-ways-diversify-your-portfolio-2026

- https://www.ishares.com/us/insights/inside-the-market/2026-market-outlook-investment-directions

- https://www.pinebridge.com/en/insights/investment-strategy-insights-assessing-scenarios-for-our-2026-outlook

- https://www.capitalgroup.com/institutional/insights/articles/2026-stock-market-outlook.html

- https://www.kiplinger.com/investing/are-you-overlooking-these-investment-opportunities-in-2026

- https://privatebank.jpmorgan.com/apac/en/insights/markets-and-investing/up-to-speed/week-of-nov-17

- https://www.blackrock.com/corporate/insights/blackrock-investment-institute/publications/outlook