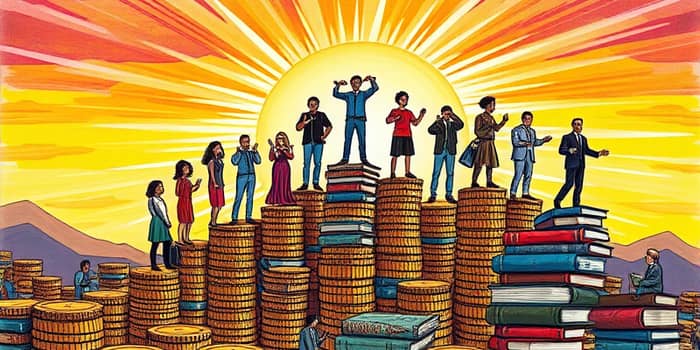

Becoming a millionaire often feels like an unreachable dream, reserved for a lucky few. Yet, with the right knowledge, discipline, and perseverance, anyone can achieve financial independence. This guide will walk you through proven strategies, real-life frameworks, and inspirational mindsets that empower you to build lasting wealth.

Understanding Millionaire Status

A “millionaire” is defined by total assets minus liabilities. It’s net worth that counts, not just cash on hand. Someone who owns $1 million in assets but carries $1 million in debt has no net worth, and thus, no millionaire status.

In modern terms, millionaire status often covers a range from one to five million dollars in net worth. Inflation erodes purchasing power, so maintaining and growing this status requires strategic planning and continuous investment.

Cultivating the Right Mindset

Before numbers come mindset. Wealth builders share distinctive habits and thought patterns. Cultivating the right mental approach sets the stage for every subsequent step.

- Delayed gratification and financial discipline

- Embrace an abundance mentality

- Dedicate time to continuous learning

- Commit to lifelong financial education

These traits help you resist impulsive spending and focus on high-impact investments over the long term.

Building a Solid Financial Foundation

Every journey begins with clear objectives and a roadmap. A strategic financial plan turns abstract goals into actionable steps.

- Establish specific, measurable financial milestones

- Create a robust emergency fund

- Eliminate high-interest debt first

- Review and adjust your plan quarterly

Document your plan like a business blueprint. Track progress, celebrate milestones, and refine strategies as you evolve.

Strategies for Accelerating Wealth

Once your foundation is set, focus on expanding income, maximizing savings, and harnessing the power of compounding.

Increase your earning potential through salary negotiations, side businesses, and passive income streams. Aim to save and invest at least 20% of your income, then gradually raise that rate as your earnings grow.

This table shows how compound interest transforms small contributions into substantial wealth over decades. Time is your greatest ally.

Protecting and Preserving Wealth

As assets grow, so does the need for protection and optimization. Tax strategies, asset allocation, and legal planning ensure you keep more of what you earn.

- Utilize tax-advantaged accounts effectively

- Implement asset protection strategies

- Diversify income with passive streams

Staying vigilant against lifestyle inflation prevents your expenses from outpacing earnings, preserving the gap you need for investments.

A Real-Life Blueprint: The Financial Waterfall Strategy

Self-made millionaire Rose Han offers a sequential “financial waterfall” that channels every dollar into the most impactful use. Her 10 steps start with a $2,000 emergency fund, move through high-interest debt elimination, and end with a diversified investment portfolio.

Key stages include:

- Emergency fund foundation

- High-interest debt payoff

- Maximize retirement account contributions

- Invest in index funds and ETFs

Han’s disciplined approach turned modest savings into a seven-figure net worth within a decade.

Paths to Millionaire Status

Multiple routes lead to wealth. Identify the path that aligns with your strengths and passions, then commit fully to its principles.

- Real estate investing for passive cash flow

- High-paying careers in healthcare and engineering

- Entrepreneurship and business ownership

- Consistent, strategic investing over decades

Combine several income streams to accelerate progress and add financial security.

Overcoming Obstacles and Maintaining Momentum

Challenges will arise: market downturns, unexpected expenses, or self-doubt. The key is resilience. View setbacks as learning opportunities, adjust your plan, and keep moving forward.

Regularly revisit your goals, celebrate small victories, and surround yourself with mentors and peers who champion your vision. Consistency, more than any single tactic, is the ultimate driver of lasting wealth.

Conclusion

The path to millionaire status is neither secret nor unattainable. It demands a clear mindset, a robust plan, disciplined execution, and unwavering persistence. By embracing these strategies, protecting your gains, and learning from proven frameworks, you can transform your financial future and join the ranks of those who have built enduring wealth.

References

- https://www.cfinancialfreedom.com/what-is-a-millionaire-the-4-levels-of-millionaire-status-defined/

- https://usfblogs.usfca.edu/edunews/2025/03/16/the-millionaire-mindset-7-strategic-steps-to-building-lasting-wealth/

- https://www.kiplinger.com/slideshow/investing/t052-s001-10-things-you-must-know-becoming-millionaire/index.html

- https://www.businessinsider.com/self-made-millionaire-financial-waterfall-strategy-tips-wealth-building-2025-9

- https://www.thirdactretirement.com/blog/millionaire-definition-what-it-truly-means-in-2025

- https://www.youtube.com/watch?v=DQdvmutrj5c