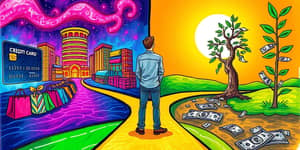

Every great financial transformation starts not with a grand gesture, but with the consistency of small moves. In a world obsessed with instant results, it’s easy to overlook the power of tiny shifts. Yet, over time, those shifts become the bedrock of credit health and financial freedom.

Why Micro Habits Matter

When you view credit improvement as a mountain to summit, the peak can feel impossibly high. Breaking that mission into bite-sized actions makes progress inevitable. Researchers and finance experts agree that small, consistent financial actions are the secret sauce to lasting credit growth.

Micro habits don’t derail your routine. Instead, they embed themselves seamlessly into daily life: a quick credit check on payday, a timely bill payment this evening, or a weekly glance at spending categories. Over months and years, these easy patterns compound, delivering substantial long-term compounding benefits.

Essential Credit-Building Micro Habits

Focusing on key areas can accelerate your credit journey. Here are the most impactful micro habits to adopt, each supported by data and real-world results.

- Checking Credit Regularly: Aim for a monthly or quarterly review. Use free tools to spot errors—incorrect balances or false late payments—and dispute them swiftly.

- Paying Bills on Time: Set calendar reminders for all due dates. Pay bills once or twice a month to ensure you never miss a deadline, reinforcing your creditworthiness.

- Managing Credit Utilization: Keep your balances under 30% of limits. Make small payments weekly to maintain low utilization ratios and demonstrate responsible borrowing.

- Reporting Rent and Utilities: Enroll in services that report your rent or utility payments to credit bureaus. It’s a frequently overlooked boost to your score.

These practices might seem trivial in isolation, but collectively they become a powerful engine for credit improvement.

Complementary Money Habits

Credit health thrives alongside broader financial wellness. Incorporate these micro habits to bolster your progress and protect against setbacks.

- Conscious Spending & Impulse Control: Implement a 24-hour rule for purchases over $50. Unlink your credit card from your phone to add friction and curb impulse buys.

- Building an Emergency Fund: Automate weekly transfers of even $25 into a no-tap savings account. Gradually increase the percentage you save each year.

- Budget & Expense Tracking: Track daily coffees, subscriptions, and takeout to identify small leaks in your budget. Review and revise twice a year to stay on course.

Psycho Foundations of Sustainable Finance

Micro habits deliver more than numeric gains. They reshape your mindset, reducing shame and boosting confidence. Each timely payment or deliberate review creates a micro victory that reinforces your commitment.

By celebrating wins—no matter how slight—you cultivate bite-sized, easy money moves that feel rewarding. Soon, managing your finances becomes less of a chore and more of a positive ritual. This approach also helps you steadily build financial self-trust and reduce shame around finances, turning fear into fuel.

Implementing Your Micro Habits

Turning ideas into action requires structure. Use cues, routines, and rewards to lock in new behaviors. Here’s a simple table to guide your implementation:

Pair these micro rituals with clear goals. Write down your target credit score or interest rate you aim to achieve. Review progress monthly, adjusting cues and rewards as needed to keep motivation high.

Conclusion: The Compound Power of Consistency

No single action guarantees financial success. But when you layer micro habits over time, their combined effect is transformational. Each credit check, timely payment, and mindful spending choice adds a brick to the foundation of your financial future.

By adopting these micro habits, you harness transform your credit profile and unlock long-lasting financial resilience. Remember, greatness is built one small step at a time. Start today—your credit score is waiting to climb, fueled by the power of consistency.

References

- https://www.quickanddirtytips.com/qdtarchive/8-micro-money-habits-for-guaranteed-success/

- https://www.ig.ca/en/insights/micro-habits-that-could-make-you-a-nbsp-millionaire

- https://wealthovernow.com/the-power-of-micro-habits-for-financial-success/

- https://www.discover.com/personal-loans/resources/consolidate-debt/good-financial-habits/

- https://moneyguy.com/episode/9-micro-habits-to-change-your-finances/

- https://www.mindmoneybalance.com/blogandvideos/microdosing-good-money-habits

- https://www.boldin.com/retirement/micro-financial-habits/

- https://bintafinancial.com/blog/7-credit-building-micro-habits

- https://www.youtube.com/watch?v=9ul0PVpQl58