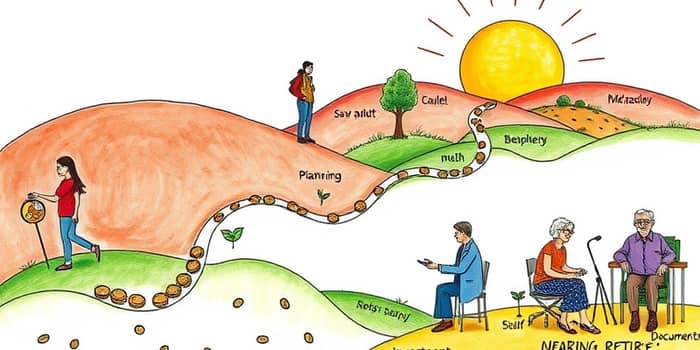

Financial planning is not a one-time event but a continuous journey that spans a lifetime. From adolescence to the golden years, each stage brings distinct opportunities and challenges. This guide offers a clear, actionable roadmap to help you stay on track and adapt as life unfolds.

Mapping Your Financial Journey

Experts often divide the financial lifecycle into various frameworks—five to seven stages or even decade-based models. These frameworks help in organizing financial priorities and goals at each milestone. By viewing your finances through the lens of life stages, you can make informed decisions that compound over time and avoid costly missteps.

Early Adulthood: Laying the Foundation (Ages 13–30)

The formative years set the stage for future success. From ages 13 to 17, focus on building financial literacy: learn budgeting basics, the importance of saving, and how interest works. As you transition to adulthood, ages 18 to 21 bring new responsibilities—UTMA/UGMA accounts, tax implications, and the need to establish healthy spending habits.

By age 26 you may lose coverage under your parents’ health plan, and by 30 you should strive to be fully independent: student loans repaid, living expenses covered, and one year’s salary saved for retirement. Aim to start your emergency fund early and develop disciplined habits.

- Create a detailed budget to manage income and expenses

- Start an emergency fund covering three to six months of costs

- Pay down student loans using income-driven plans

- Open and contribute to a retirement account (IRA or 401(k))

- Secure health insurance and review benefits

Marriage and Family: Building Together

Combining households introduces new dynamics. With two incomes, you can accelerate savings but must also plan for childcare, parental leave, and a home purchase. Early investments in education through 529 plans pay dividends later, while adequate life insurance and estate planning protect your loved ones.

Whether blending debts or merging bank accounts, communication and shared goals are paramount. Make time to review coverage and legal documents, ensuring both partners are aligned and protected.

- Merge finances thoughtfully, keeping joint goals in mind

- Review and adjust life insurance policies regularly

- Establish a will, durable power of attorney, and advance directive

- Open a 529 College Savings Plan with automatic contributions

Career Advancement and Mid-Career Milestones (Ages 40–50)

By age 40, aim for three times your annual salary saved for retirement and increase contributions to at least 15% of gross income. Investing expertise grows, and you may need to support children in college while assisting aging parents.

At 50, your savings target should reach six times salary, unlocking catch-up contributions for IRAs and employer plans. It’s also a prime time to deepen your understanding of Social Security, Medicare, and advanced tax strategies.

- Review investment portfolio and asset allocation annually

- Increase retirement contributions to meet benchmarks

- Consult a fee-only financial advisor as net worth grows

- Balance risk and growth to protect against market swings

Nearing Retirement and Pre-Retirement Strategies

Once you hit age 59½, withdrawals from IRAs incur no penalties, and at 62 you can access Social Security—though full benefits come later. Medicare eligibility begins at 65, requiring careful coordination with Health Savings Accounts and supplemental coverage.

Required Minimum Distributions start at age 73 or 75, depending on your birth year under the Secure Act 2.0. Use this phase to shift your investments to income-focused assets and fine-tune withdrawal strategies that minimize taxes and sustain your nest egg.

Retirement and Aging: Sustaining Your Legacy

Retirement is the reward of decades of disciplined saving and investing. Now, focus on creating a sustainable income stream: consider annuities, bond ladders, and tax-efficient withdrawals. Qualified Charitable Distributions become available at age 70, enabling you to support causes close to your heart while reducing taxable income.

As health needs evolve, long-term care planning and Medicare supplements become critical. Estate planning ensures your legacy endures, transferring wealth smoothly to heirs or charities.

Bringing It All Together

Your financial blueprint is a living document, evolving with each stage of life. By following benchmarks and taking plan for children’s education costs, you build momentum. When mid-career demands peak, remember to maximize your retirement contributions and periodically rebalance.

In the final stretch, let your strategy adapt to income needs, healthcare changes, and legacy goals. Working with trusted professionals and maintaining flexibility will help you preserve wealth for future generations and achieve lifelong financial security and peace.

References

- https://www.rwroge.com/2023/11/how-life-changes-affect-your-financial-planning-needs/

- https://njaes.rutgers.edu/sshw/message/message.php?p=Finance&m=364

- https://incomelaboratory.com/understanding-life-cycle-financial-planning/

- https://www.totalclaritywealth.com/blog/lifetime-financial-milestones-navigating-key-life-events-2025

- https://www.hartfordfunds.com/insights/investor-insight/navigating-longevity/8000-days-of-retirement/milestone-ages-for-financial-planning.html

- https://www.acg.aaa.com/connect/blogs/5c/money/guide-to-financial-planning-for-every-stage-of-life

- https://www.birchwoodfp.com/milestones

- https://guides.loc.gov/personal-finance/life-stages

- https://heritagefinancial.net/financial-planning-by-age/

- https://www.citizensbank.com/learning/financial-planning-for-every-stage-of-life.aspx

- https://www.fidelity.com/learning-center/personal-finance/financial-goal-examples

- https://moderawealth.com/financial-planning-through-a-clients-life-stages/

- https://blog.harvardfcu.org/financial-milestones-to-hit-by-25-35-45-and-beyond

- https://www.usbank.com/wealth-management/private-wealth-management/financial-planning-through-life-stages.html